SMM reported on May 15 that although SS futures contracts fluctuated downward today, the previous price rally had firmly pushed the price above the 13,100 yuan threshold. Consequently, today's correction did not spill over into the spot market, with stainless steel spot prices remaining resilient. Benefiting from the prior price rally, transaction activity in the spot market significantly increased. SMM data released on the same day showed that stainless steel social inventory declined by 0.85% WoW this week, confirming the market's destocking trend. However, the current high level of market transactions is mainly attributed to the price rally driven by previous favourable macro front, which has collectively released previously suppressed demand. The market widely fears that after short-term concentrated procurement, there remains significant uncertainty regarding the sustainability of downstream stainless steel consumption.

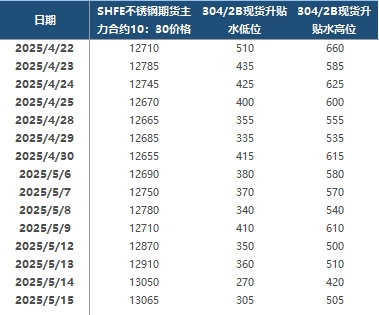

In the futures market, the most-traded 2507 contract strengthened and rose. At 10:30 a.m., SS2507 was quoted at 13,050 yuan/mt, up 140 yuan/mt from the previous trading day. In the Wuxi region, spot premiums/discounts for 304/2B stainless steel ranged from 270-420 yuan/mt. In the spot market, cold-rolled 201/2B coils in both Wuxi and Foshan were quoted at 8,050 yuan/mt. The average price of cold-rolled trimmed 304/2B coils was 13,225 yuan/mt in Wuxi and 13,200 yuan/mt in Foshan. Cold-rolled 316L/2B coils were priced at 23,850 yuan/mt in Wuxi and the same in Foshan. Hot-rolled 316L/NO.1 coils were quoted at 23,050 yuan/mt in both regions. Cold-rolled 430/2B coils were priced at 7,500 yuan/mt in both Wuxi and Foshan.

Recently, multiple favourable macro factors, including adjustments to Sino-US tariff policies and weaker-than-expected US CPI data, have injected strong momentum into the stainless steel futures market, driving futures prices to continue climbing. The easing of tariff policies has directly alleviated market concerns about export disruptions, while the weaker US CPI data has strengthened expectations for US Fed interest rate cuts, further boosting confidence in the commodity market. However, the market still faces numerous constraints: on one hand, there is uncertainty regarding the final implementation and sustainability of the tariff policies; on the other hand, stainless steel market supply continues to remain at historically high levels, and the supply-demand imbalance has not been fundamentally alleviated. Meanwhile, as prices of raw materials such as high-grade NPI and high-carbon ferrochrome weaken, the cost side's support for prices has somewhat diminished. Against this backdrop, the actual recovery of downstream end-use consumption will become a key variable determining the trend of stainless steel prices, requiring continuous close attention.

![Before the holiday, the black chain is unlikely to see a trend-driven market [SMM Steel Industry Chain Weekly Report].](https://imgqn.smm.cn/usercenter/zUFfM20251217171748.jpg)

![[SMM Chromium Daily Review] Inquiries and Transactions Weakened, Chromium Market Showed Mediocre Performance Before the Holiday](https://imgqn.smm.cn/usercenter/ENDOs20251217171718.jpg)